Rachel Reeves delivered her Budget yesterday afternoon. Amongst several big announcements, there were two key points which are relevant to the property market.

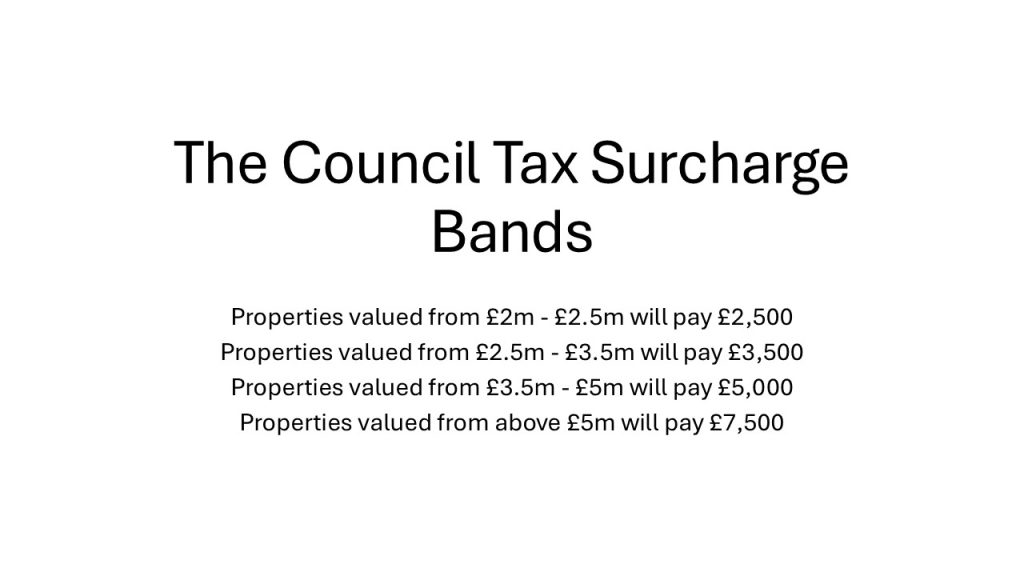

Homes in England with a value of more than £2,000,000 are to be subject to a surcharge of at least £2500. This policy has been dubbed the ‘mansion tax’ and will take effect from 2028. The charge will be payable in addition to the existing level of council tax and will increase depending on the price of the property with four separate bandings. This policy forms part of a wider range of tax rises designed to meet the chancellor’s own self-imposed rules. This means that although the normal council tax contribution will continue to go to the relevant local authority, the surcharge will go directly to the Treasury. The majority of the properties affected by this change will be in and around London but there are a number of properties in Christchurch, Highcliffe, Bransgore and Southbourne that will be impacted as well. The government will be looking at properties in F, G and H bandings and assess them based on 2026 valuations provided by the government’s Valuations Office Agency.

A big talking point for landlords is the increase in tax charged on rental income. From April 2027, an additional two percentage points will be added to the tax paid on income from a rental property. This will reduce returns for landlords which could of course have a knock on effect for rental values or even the availability of rental properties should some landlords decide to exit the market. Either way, our Lettings Office are well placed to help with any queries relating to this change.

There was some speculation over the last few weeks that there might be some amendments to stamp duty, but no change was forthcoming. Instead, once the dust settles on changes for those with high value homes and property investments, we anticipate a positive outlook for 2026 with more buyer certainty and confidence.

For more information on the Budget, you can follow this government link.